Coinsurance is a great topic for us to discuss here because it truly is confusing. Every insurance plan has some form of coinsurance, meaning this term will impact your wallet whether you like it or now. 80/20 is one of the most common forms of coinsurance and will apply to most people across the country.

80/20 coinsurance is the standard amount for traditional Medicare part B.

If you would like to learn more about Medicare and Medicare Advantage, check out my book on Amazon.

What is coinsurance?

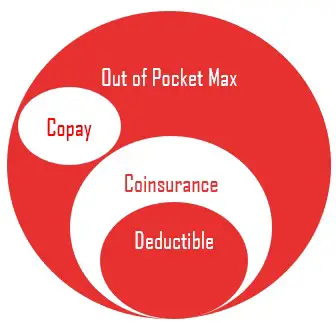

The percentage amount that you are responsible to pay once you have met your deductible is coinsurance.

As a quick refresher, most insurance plans come with a deductible amount. This amount is how much you have to pay before your insurance starts to kick in. Once you have met your deductible, your insurance company starts paying for things. Once coinsurance begins, the insurance company and you split your medical bills.

It’s typical for coinsurance to be largely the responsibility of the insurance company!

80/20 coinsurance meaning

80/20 coinsurance means that once you have met your deductible, you are responsible for 20% of the remaining balance. 80/20 coinsurance is a very common and good feature of a health plan.

An example of 80/20 coinsurance

For example, you have a deductible of $800 and coinsurance of 20%. Once you have paid $800, you are only responsible for 20% of your balance until you have met your out-of-pocket maximum.

Understanding 80/20 coinsurance

Confusion enters into the conversation because the unknown balances with health expenses. Most people aren’t sure of how much their procedure will cost, thus making it difficult to budget a percentage of it. Sadly, many health plans just say that you will pay 20% of the balance, leaving you to guess on the rest.

The good thing about coinsurance is that its temporary. You will only pay it until you hit your out-of-pocket maximum. Consider a plan with an $800 deductible, 20/80 coinsurance, and an out-of-pocket max of $1,500. You will pay your $800 deductible, and 20% of your balances until you have spent $1,500. Once you have hit that $1,500 out-of-pocket max, you will no longer be responsible for payments covered by health insurance.

How to budget for health expenses

As I mentioned, saving enough to cover coinsurance is simply not feasible. My recommendation is to save up to the amount of your out-of-pocket maximum. If you have this amount accessible in the bank, there are no amount of surprise bills to set you into a spiral of medical debt.

Almost all health insurance plans have an out of pocket maximum. Traditional Medicare does NOT have an out-of-pocket maximum, which is why I almost always recommend a Medicare Advantage plan for seniors. To learn more about Medicare Advantage, check out my book on Amazon!

The Bottom Line

As a reminder, reading “80/20 coinsurance” as a part of a plan is a good thing. While there are richer plans out there that even offer 0 coinsurance, they might have higher monthly premiums. 20 coinsurance is extremely common and part of a normal plan. If you have questions, feel free to contact me.

Comments

One response to “80/20 Coinsurance: What does it mean?”

[…] 20 Coinsurance: What does it mean? […]