One of the most confusing parts about health insurance is the lingo. For those not working in the insurance industry, these terms don’t have much meaning. When trying to pick a new health plan or even interpret your own health plan, knowing the difference between copay vs coinsurance vs deductible is important. Each of these terms has their own associated costs and can drastically change the make-up of any health insurance plan. I’ll dig into each of these terms and how they impact your wallet.

If you are looking for a resource for Medicare Advantage, check out my book on Amazon.

What is a copay?

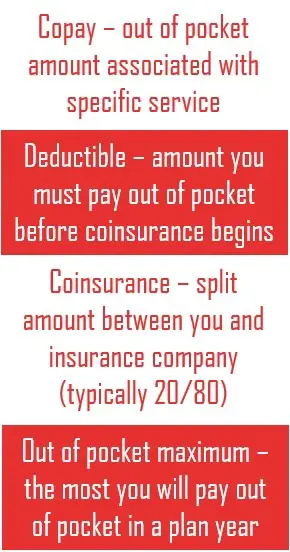

Copays, or copayments, are fixed amounts paid to your healthcare provider when you receive a service. When you see copays on your health insurance plan, it is usually a $20-500 fee for a specific service (MRI, Office Visit, ER visit).

An example of a copay

For example, to see a specialist the insurance company might require a $50 copay to help cover the cost of the service. Many times, preventive care like annual preventive primary care appointments have a $0 copay.

The purpose of the copay is to prevent people from unnecessarily utilizing health services. Whether or not the copay has contributed to this effort is questionable. Copays are often associated with prescription drugs as well.

Do copays count towards my deductible?

Copays do not typically count toward your deductible, but do count towards your out-of-pocket max. Your out-of-pocket maximum is the most you will pay out-of-pocket in a given year.

What is coinsurance?

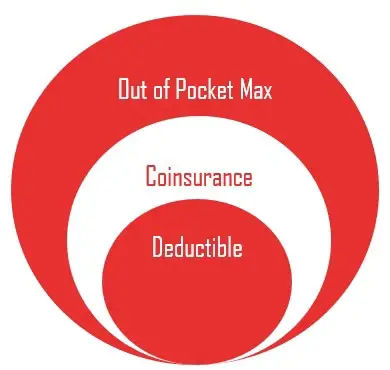

Coinsurance payments are made after you have met your deductible. It is a percentage of the medical bill that you split with your insurance company until you reach your out-of-pocket maximum.

An example of how coinsurance is calculated

Here is an example: You have a $1,000 deductible with 20% coinsurance and a $3,500 out of pocket max. You can expect to pay $1,000 out of pocket and then your insurance plan kicks in.

From that point forward, you will pay 20% of payments while your insurance plan pays 80%. You will continue to pay 20% of payments until you have paid a combined out-of-pocket total of $3,500. This includes the $1,000 deductible and $2,500 of coinsurance.

What is a deductible?

The deductible is the amount that you have to pay out-of-pocket before your insurance plan starts to kick in. This figure differs among plans, but is generally anywhere between $500 and $1,500.

Different plans have different deductibles

If you have a PPO or HMO, you can expect to have a reasonably low deductible. This means you will pay little out of pocket before your insurance plan starts covering costs. The trade-off is the higher premiums that you pay each month. With a high deductible health plan (HDHP), you can expect to pay a lot out of pocket in exchange for a low monthly premium.

Need help?

Knowledge of these three terms is super important in picking a health plan. If you have questions about your plan, I can help provide clarity.

Comments

2 responses to “Copay, coinsurance, deductible: Confused?”

[…] it truly is confusing. The percentage amount that you are responsible to pay once you have met your deductible is coinsurance. For example, you have a deductible of $800 and coinsurance of 20%. Once you have […]

[…] to cover costs associated with Medicare. For those with Part A and Part B, Medigap plans can cover copayments, deductibles and coinsurance. While not as comprehensive as Medicare Advantage, Medigap plans are great for those that travel or […]