0 coinsurance is a great topic for us to discuss here because it truly is confusing. Many people have reached out about coinsurance because its one of the many terms they have to understand when picking a plan.

Below is a quick review of topics for this post:

What is coinsurance?

The percentage amount that you are responsible to pay once you have met your deductible is coinsurance. For example, you have a deductible of $800 and coinsurance of 20%. Once you have paid $800, you are only responsible for 20% of your medical bills until you have met your out-of-pocket maximum.

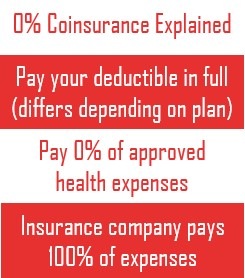

What is 0% coinsurance?

0 coinsurance means that once you have met your deductible, you are responsible for 0% of the balance. 0 coinsurance is a rare, but good feature of a health plan.

As a reminder, reading “0 coinsurance” as a part of a plan is a great thing. One thing to keep in mind is that your monthly premium may be higher with a plan that offers this rich of benefits. Your monthly premium is the amount of money that is taken out of your paycheck each month and allocated towards health insurance.

The Pros and Cons of coinsurance

Pros of coinsurance:

The good thing about coinsurance is that its temporary and it helps pay for medical expenses. You will only pay it until you hit your out-of-pocket maximum.

An example of how coinsurance is calculated:

Consider a plan with an $800 deductible, 20/80 coinsurance, and an out-of-pocket max of $1,500. You will pay your $800 deductible, and 20% of your balances until you have spent $1,500. Once you have hit that $1,500 out-of-pocket max, you will no longer be responsible for payments covered by health insurance.

Cons of coinsurance:

Once you have coinsurance, you are responsible for a percentage portion of the medical bill. Most people aren’t sure of how much their procedure will cost, thus making it difficult to budget a percentage of it. Sadly, many health plans just say that you will pay 20% of the balance, leaving you to guess on the rest. This happened to my wife and me during our first child, where we had a HDHP while pregnant. Fortunately with 0 coinsurance, you will not face this issue.

Medicare coinsurance explanation

20/80 coinsurance is the standard amount for traditional Medicare part B. If you would like to learn more about Medicare Advantage, check out my book on Amazon that highlights the major changes coming in 2022.

I’m happy to help answer any confusion or help you plan for health expenses.