Are you pregnant and trying to figure out whether or not you should enroll with a PPO or HDHP? This is the reason I started this blog! My wife and I were in the same situation, only we didn’t have a choice. Open enrollment had just passed when we found out we were pregnant. We had a high-deductible health plan (HDHP) paired with a health savings account (HSA). I’ll give a breakdown here about what we wish we would have known going into the process.

Topics covered in this post:

- Our experience with a HDHP during pregnancy

- The difference between a HDHP and a PPO

- What to expect while pregnant with a HDHP and HSA

- What to expect while pregnant with a PPO

- My recommendation

HDHP: What we had when pregnant

We found out we were pregnant in November right after my wife’s open enrollment at work ended. We were stuck with a HDHP and an HSA and were worried about the costs that were coming our way. The difficult thing about pregnancy is that nobody can tell you how much it costs. Here are a few things to consider:

- Costs of prenatal vitamins, belly butter, and maternity clothes

- Expense of the OB/GYN visits leading up to the birth

- Fees of the ultrasounds and bloodwork at those visits

- Any emergency trips to the ER (we had one)

- The actual delivery costs

- The room and board of the hospital

- Drug costs (anesthesia!)

- If you require a stay afterwards for jaundice (we did), feeding and growing, etc.

For a full list of HSA-eligible products I recommend, read this post!

We were worried about how much this was going to cost us with a HDHP. My wife’s plan specifically had a deductible of $2,000 before the insurance kicked in and started cost-sharing. That means we had to pay $2,000 out-of-pocket before we really had any coverage. Luckily, the premiums each paycheck were relatively low.

The main philosophy difference between HDHP and PPO

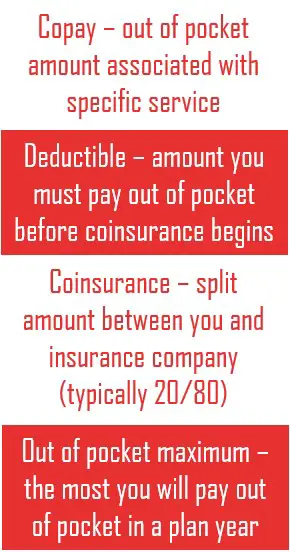

A HDHP has low monthly premiums and a higher deductible. This means your paycheck is bigger but if you incur medical costs, you have to pay more upfront. This makes a HDHP perfect for someone who is healthy and does not anticipate significant health expenses. These plans typically come with an HSA, which allows you to put pre-tax money into an account that can be used on health expenses.

A PPO has higher monthly premiums and a lower deductible. Again, your paycheck will be smaller, but if you incur medical costs you don’t have to pay that much before you’re covered.

How to be pregnant with a HDHP

Once we realized our situation and knew that we were locked into a HDHP and an HSA, we did the best we could to prepare. Here are a few things we did:

- We maxed out her contributions to her HSA.

- With an HSA, you have the ability to contribute a set amount to it each year. With this amount, you can pay for those up-front, out-of-pocket costs with tax-free money. This essentially gives you a 30-50% discount on all medical expenditures. Also, most employers will put in $500 or so into your HSA as an added benefit.

- We used the HSA….A LOT

- All of her OB appointments, bloodwork, etc. that we had to pay upfront we expensed directly to the HSA. This was a separate debit card that she would swipe at all of her appointments. If there was ever a time when she didn’t have enough money in the HSA (which was often), we put it on our normal credit card and kept the receipt. When she had enough in her HSA, we reimbursed ourselves for the expenses. Click here to learn more about what you can purchase with an HSA.

- We took advantage of insurance company offerings

- My wife had Cigna insurance during this pregnancy. They offered something that gave us a $200 gift card if she had monthly meetings with a risk counselor. The counselor asked questions about her pregnancy plan, asked if she was using any drugs, etc.. This was an easy way for us to apply “free” money to our health bills. I’m assuming a lot of health insurance companies do this.

These strategies helped us get a massive discount on our deductible, as it was mostly tax-free money being used via the HSA. Once we hit the deductible, we had more help from the insurance company and still had $1,500 left in the HSA to use.

PPO during pregnancy

With a PPO, your experience will be a lot simpler and straightforward, but not necessarily less expensive. You can expect to have a smaller deductible that you can hit pretty quickly, but this will have to be met with after-tax (normal) money. Once this has been met, your insurance plan will cover most of your expenses. The hospital expenses, however, will still be relatively high. Expect your insurance plan to cover a high percentage of these costs, but you will still have to pay a small percent. Sadly, a small percent of $5,000 – $10,000 is still a lot of money!

I say that PPOs may not necessarily be less expensive because they have higher monthly premiums, meaning your paycheck is smaller each month.

PPOs are great when having a child if you don’t want to worry about all of the mental math that goes into a HDHP with an HSA. PPOs are generally how most people think of health insurance, so it is easiest to grasp and work with.

A financial tip for HDHP and PPO

The downside of all health insurance plans are that you don’t really know how much things are going to cost. If you have a c-section and a 5 day NICU stay with your baby, your expenses will be much higher than someone with a natural birth and one-day stay. My recommendation is to always save up to your out-of-pocket maximum for your plan. This is the most you will have to pay out of pocket in a given plan year. Any surprise bill after this point will be covered by insurance. You can find the out-of-pocket maximum in your statement of benefits, which should be provided to your employer and you when you are enrolled in a plan.

Things we wish we would have known with our HDHP

One thing we really wish we would have known going into this is what happens when your baby gets insurance. We tried and tried to get information from Cigna beforehand, but couldn’t find anything. They told us to ask our employer who told us to ask Cigna who told us to ask our employer. We got bounced around and ultimately gave up.

We wish we would have known that your deductible and out-of-pocket max INCREASE to a family plan once the baby is born. This means from this point forward, your deductible increases from say $500 to $1,000. If any medical claims have not been processed from before the pregnancy, you will have to pay your deductible over again as you now have a “family plan”. This happened to us because my wife and I were on separate insurance plans. If you and your significant other are on the same plan, you may experience this to a lesser degree, or not at all depending on your plan.

Crossing over plan years

The worst case scenario from a health insurance perspective is to give birth early in the year! At this point, you have probably already met your deductible in the prior year. Sadly, it starts over January 1st and you will have to pay that money all over again. This is when it is helpful to have a HDHP with an HSA as you can reimburse yourself throughout the year.

My recommendation for pregnant women

My recommendation is to go with what works for you. If your health insurance and financial situation is something you don’t want to pay too much attention to, go with a PPO. If you want to try to maximize benefits, reimbursements and save some money, you can figure it out with a HDHP and an HSA.

Most of us won’t have the luxury of picking our plan – we didn’t. We just got lemons and made some lemonade (and a baby). You can figure out how to have this baby with whichever health insurance plan you have, it just might require more focused efforts.

Contact me if you have any questions about your plan and want help.