Medicare Part B costs are adjusted for your yearly income, based on the two years prior. For example in 2022, your Medicare costs will be based off of your 2020 tax return. Medicare income limits applied to these numbers can drastically change your monthly costs.

Each year, Medicare tends to raise their prices to keep up with inflation. 2022 is no different, as it appears the costs will increase again thanks in large part to the pandemic.

Here is what we will cover in this post:

- How much does Medicare cost?

- A Medicare Income Limit chart

- How to get better Medicare for free

- Pros and cons of Medicare Advantage

The Basics: Medicare Parts and Costs

Medicare has two parts: A and B. Part A covers general hospital-related costs, like an inpatient hospitalization. Part B covers outpatient costs like physician services, outpatient imaging, etc.. Each comes with different monthly premiums, or the amount that you have to pay for coverage each month. They also have different deductible amounts, or the amount paid before Medicare “kicks in” and starts paying for medical expenses.

Medicare Part A costs in 2022

Medicare Part A is premium-free for most recipients. If you have paid into Medicare by contributing for 40 quarters (10 years) of your life, then you will receive part A premium free at 65.

Your income levels do not impact Part A costs.

Medicare Part B costs in 2022 and the income impact

Medicare Part B costs in 2022 are $170.10 – an increase of $21.60 over 2021.

The new Medicare Part B premium in 2022 will also be income-adjusted for those earning a higher income.

Medicare Part B in 2021 was $148.50 at its base rate, which reflects lowest income. Income adjustments impact the monthly premium amount in something called IRMAA (Income-Related Monthly Adjustment Amount). Only about 7% of Medicare recipients pay IRMAA, but the impacts are very large.

Medicare Income Limits Chart for 2022

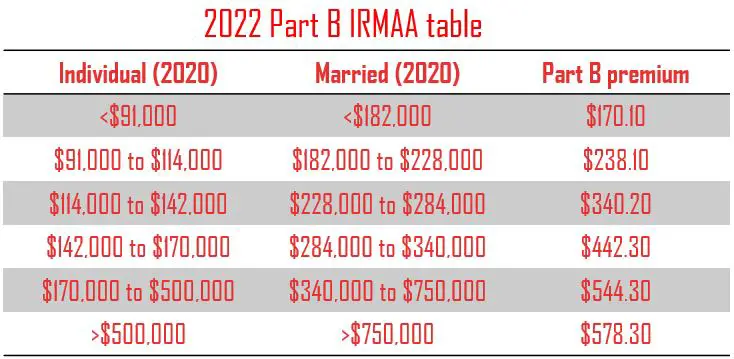

There are six tiers to IRMAA which dictate the additional premium amount that you will be paying. As expected, the higher your income, the higher the surcharge that you pay.

As seen in the visual above, monthly premiums can almost triple for those in the highest income categories. Make sure to watch your income to prevent moving into a higher tier. As you can see, the impact is almost $90 per month by moving up each tier.

How to get the most out of your Medicare in 2022

As Medicare costs rise, benefits stay mostly the same. This is why I almost always recommend a Medicare Advantage plan. Medicare Advantage plans often come at $0 additional monthly premium but include incredible benefits that can help you lead a healthier lifestyle.

**UPDATE**: As of October 1st, the Center for Medicare Services has announced that Medicare Advantage premiums are DROPPING in 2022, from over $21/month $19/month. This is astounding considering the Part B premium will likely increase dramatically.

This means that Medicare Part B is providing the least value it ever has, while Medicare Advantage is providing the most.

If you’re interested in learning everything you need to know about Medicare Advantage, buy my book on Amazon for a super low price.

Medicare Advantage benefits in 2022

Medicare Advantage has a key financial benefit not found in traditional Medicare: an out-of-pocket max.

This protective mechanism ensures that you will not spend more than a certain amount on health expenses in a plan year. Most Medicare Advantage plans will not cost extra, but can protect you from losing your hard earned savings on healthcare.

Medicare Advantage 2022: Advantages and Disadvantages

Advantages:

Advantage plans often come with great additional perks. Some of my favorites include basic coverage for vision and dental care. Why pay for dental insurance or vision insurance when it can be included for free in a Medicare Advantage plan?

Many advantage plans also provide coverage for unique services, like telehealth. Some include gym memberships, social clubs, and more. They also do not include any Medicare Income limits to their additional premium, but you will still have to pay the normal Part B premium.

Disadvantages:

A disadvantage to Medicare Advantage is the limited number of providers you can see. Since most of these plans are PPOs or HMOs, they only allow a certain network of providers.

This is not a cause for concern if you like the network, but can be a disadvantage for those that travel frequently or spend part of the year in another city.

The Bottom Line

Medicare Part B premiums are income-adjusted and are set to rise significantly in 2022. Be careful to monitor your income and where you fall into the increased premium brackets. Consider a Medicare Advantage plan to help provide additional benefits and financial protections.

Want more information before making a final decision? My book will fully arm you for whatever plan you choose to pick.