If you are new to Medigap, AKA supplemental Medicare, you may not know that a few of the plans offer high-deductible plans. These plans are my favorite type of Medigap plans. I’ll explain why after we answer a few of the basics.

Here’s what we will cover in this guide:

- What is supplemental Medicare aka Medigap?

- What is a high deductible supplemental Medicare plan?

- Which Medigap plans offer high deductibles?

- Why you would get a high deductible Medicare plan

- How to protect yourself financially

What is a supplemental Medicare plan?

Supplemental Medicare (AKA Medigap) is a private insurance plan that covers some of the out-of-pocket costs of traditional Medicare.

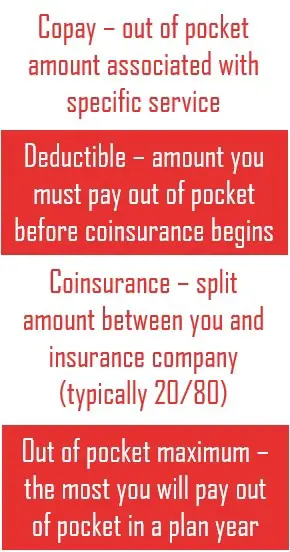

Medicare has two parts in its most basic form: A and B. When you visit the doctor or are hospitalized, you may have to pay out of pocket for things like co-pays. Supplemental Medicare will cover the costs of copays and deductibles to varying degrees depending on the plan.

What is a high deductible supplemental Medicare plan?

A deductible is the amount you pay out of pocket before your insurance plan kicks in. A high deductible plan is a plan that has a higher deductible than most other plans, meaning you pay more out of pocket up front. I know what you are thinking: why on Earth would this be a good thing?

Similar to a high-deductible health plan, high-deductible Medigap plans offer lower monthly premiums. This means that if you have one of these plans, you will pay a smaller amount each month in your premium expense, but more out-of-pocket if you have a health expense.

Which Medigap plans offer high deductible plans?

Medigap plans F, G, and J offer high deductible plans. Plan F is the most popular plan, but will soon be overtaken by Plan G.

For those that are newly eligible to Medicare after 2020, Medigap Plan F is no longer being offered. My next favorite is Plan G as it is the most comprehensive and available to new enrollees in Medicare. I’ve written an extensive article on differences between Medigap plans that is helpful for sorting through these. Plan J is no longer offered for those that became newly eligible to Medicare after 2010.

Why should I get a high deductible supplemental Medicare plan?

High deductible plans are great for Medigap because you can save a ton of money on health expenses while still being covered for major expenses. If you are relatively healthy but like the comfort of additional coverage, a high deductible Medigap is perfect. You will have low monthly premiums in addition to your normal Part B premium, but will have excellent coverage for Parts A and B once you hit your deductible.

Medigap plans are perfect for those who spend time traveling or have homes in two different places as compared to Medicare Advantage, which generally restrict the providers you can see to your geographic locale.

What about the out-of-pocket maximum?

Most Medigap plans don’t have an out of pocket maximum. The plans offered here (F, G and J) don’t have out-of-pocket maximums, which means you will never be 100% covered after spending a certain amount.

Medicare Advantage plans do offer these and may be the right choice for you. Check out my book on the topic:

Need help figuring out which plan is right for you? Contact me and I’d be happy to help.