Many people ask me if their copay goes towards their deductible. Copays are a frustrating aspect of health insurance. When you show up to the doctor, you have a surprise copay that you were not expecting to pay because you have great insurance. Surely there has to be some benefit to this, right? Well….kind of? I’ll dig in below.

If you are asking specifically for Medicare Advantage, check out my book on the topic.

Topics covered:

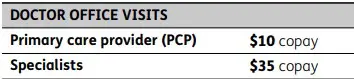

What is a copay?

A copay is a fixed amount that you must pay for a certain health-related expense. Copays are dictated by your health insurance company and were created to prevent unnecessary utilization of health services.

Why do I have to pay a copay?

The copay exists so that you “feel” the cost of going to a new healthcare provider. Is it a good thing? Definitely for the health insurance company but maybe not for you.

An example of a copay is having to pay $50 to see a specialist like a cardiologist or OB/GYN.

What is a deductible?

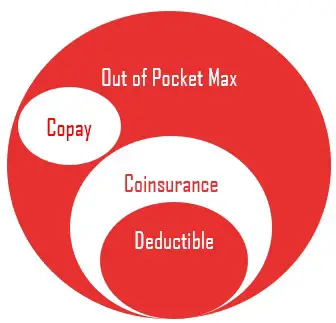

The deductible is the amount of money that you have to pay before your health insurance kicks in. For plans like preferred provider organizations (PPOs) or health maintenance organizations (HMOs), deductibles are generally low. For high-deductible health plans (HDHPs), deductibles are high (duh).

Why is the deductible important?

Once a deductible is met, coinsurance kicks in. Coinsurance is basically your health insurance company saying “we will split the cost”. A typical coinsurance amount is 80/20, where the insurance company covers 80% of the cost. Coinsurance amounts can also be 100/0, meaning you pay nothing once you have hit your deductible.

You want to hit your deductible ASAP if you are someone who has many health expenses. This will reduce your out-of-pocket costs and help better coverage kick in.

After a certain point of out-of-pocket spending, you hit your out-of-pocket maximum. After this point, you owe nothing and insurance covers everything that it approves.

So does my copay go towards my deductible?

Generally, no. Copays do not go towards your deductible, but will go towards your out-of-pocket maximum.

A fun example my wife encountered

My wife has a HDHP with an HSA. She went to her primary care provider for a preventive visit, which was 100% covered by health insurance. While at the doctor’s office, they asked her about pregnancy and if she had any concerns. She voiced a few concerns and the doctor did some bloodwork.

Sadly, we received a bill for an office visit and not a preventive visit. This means my wife now had to pay a copay for the visit and the entire bill as she has not yet met her deductible.

Fortunately, we were able to use her HSA to cover the costs. The copay she paid did not go towards her deductible (but was covered by the HSA) and the other visit costs did go towards her deductible.

The bottom line

Health insurance is a confusing game without much transparency. The worst part is that doctors often do not understand it either, meaning they will not navigate it for you. You have to educate yourself and take control of the process or else you will receive many surprise bills.

Copays will not go towards your deductible. Make sure to understand that before visiting a doctor and factor it into your overall health spending budget.

Comments

One response to “Does a copay go towards my deductible?”

[…] Does a copay go towards my deductible? […]